From Wikipedia:

Bartercard is the world’s largest barter trading exchange. Bartercard enables member businesses to exchange goods and services with other member businesses without using cash or cash equivalents, or having to engage in the direct two-way swap of goods and/or services. It was established in Australia in 1991 and operates in over 13 countries with a member database of over 55000.

Members earn Bartercard Trade Dollars for the goods and services they sell and this value is recorded electronically in the member’s account database.

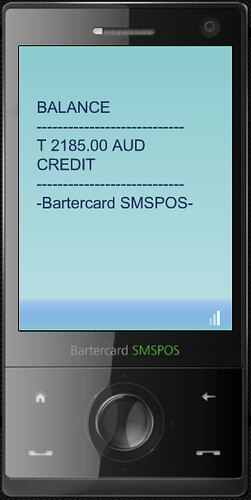

In January 2008, BarterCard introduced a SMS-based service that allows merchants to process transactions immediately with funds being transferred into their account at point of sale. The service also supports balance inquiry. The user guide can be found here. I also put some screenshots below from their online demo.

Although the balance inquiry is pretty standard in mobile banking, the SMS-based POS transaction processing is I think really unique.

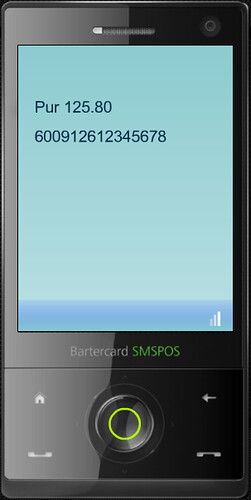

To process a sale to a BarterCard , the merchant simply types “Pur [Amount] [BarterCard number]”, sends it to the BarterCard phone number (saved as contact) and if the transaction is successful, receives a 10 digit reference number composed of a 4 digit BarterCard SMSPOS reference number and a 6 digit BarterCard Authorization number.

Of course, one might ask the kind of protection provided against fraud and the user guide only mentions:

We do advise you that you retain a proof of sale from the purchaser in the form of a signed receipt of invoice. If the sale is ever contested, you will be required to provide this proof.

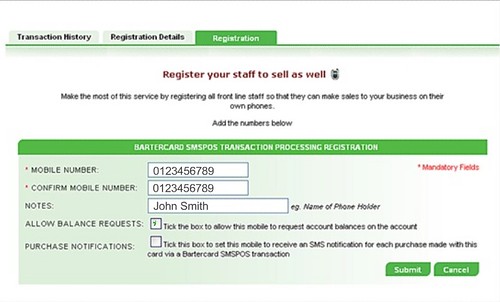

The other security feature is that at registration, members can register to be notified whenever they make a purchase that’s processed via the SMSPOS service (as opposed to processing a purchase).

So, what’s interesting here is that a very low-tech solution in terms of fraud prevention. It seems that fraud policing is done by members and resolved by BarterCard employees. It would be interested to hear from BarterCard about their fraud statistics, if any. This would be a great demonstration of how social capital can be used to prevent fraud.

Going back to the functionality of the SMSPOS service, there are two other advanced features:

- A previous transaction can be retried by typing and sending “Retry [Amount] [BarterCard Number]”

- A transaction can be reversed (1 hour window) by typing and sending “Rev [Amount] [previously received 4 digit BarterCard SMSPOS reference number], for instance “Rev 40.50 0022″.

These barter systems seem to be just loyalty programs combined with discount coupons. Assume you are a service provider with spare capacity. By agreeing to provide your services in exchange for barterbucks, you may attract some members of the group as new clients (loyalty function). Because buyers are paying with services of their own, which are presumably done at a relatively low cost to themselves, these payments feel like discounted prices to the buyers (discount function).

Indeed. Barter networks are like trading clubs or closed wall marketplaces. By artificially restricting the number of merchants accepting the currency, they create demand for these merchants.

Indeed. Barter networks are like trading clubs or closed wall marketplaces. By artificially restricting the number of merchants accepting the currency, they create demand for these merchants.

Helpful article, thanks. I've switched over to bartering recently for most of anything I can get without having to shell out cash. There are a couple sites out thereto use, to connect with people who are looking to barter trade/swap items or even services (carpentry work for auto work, etc). One of the sites I use is Baarter – http://baarter.com