7 years ago exactly today, Steve Jobs introduced the iPod, a 5GB HDD stylish music player.

Looking back, this was one of Apple boldest strategic moves and one of its most successful as well. It’s good to look back at the choices they made and wonder what the equivalent would be in the financial services world.

- They identified a large non-speculative market with no market leader (music).

- They laser-focused on a “quantum leap” value proposition: “your whole music library in your pocket” at a fraction of the TCO per song provided by other products.

- They chose the best technology they could find to power this value proposition: thin HDD, fast-charge long-lasting battery, and fast uploading FireWire link.

What could be a comparable innovation in financial services and where could it come from? Here’s my take.

- Large market: personal money management

- Quantum value proposition: complete peace of mind

- Technology: real-time access by the service provider to any financially-relevant information about you (expenses, assets, liabilities, goals, etc.) and automated creation of a sound and realistic plan.

I know some will strongly disagree with me, but my feeling is that just like the iPod didn’t come from an established music label/distributor, the iPod of financial services may not come from an established financial services provider (just like music labels/distributors, financial services providers are too busy these days to save their business models).

That does not mean it will come from a start-up either. The key will be to leverage an established trusted brand, and establishing a trusted brand requires much more than a top-notch team, VC money and unique technology and value proposition.

Looking at the consumer perspective, it seems to me that there is currently a stronger-than-average interest in trusting a single brand for a given problem, and leaving it to them to make the choices for you (and focusing on what you do best). Yes, Windows lets you decide where to put your application money, but for most computer non-geeks, less choice is more.

Financial Services are a bit like Windows these days. Many choices are offered but consumers feel they are left to decide what’s best for them in a world they don’t understand.

To come back to my comparison to the iPod, many consumers don’t want to have to know where to click, which audio file formats to use, which software to use, where to shop, etc. they just want to enjoy their music. I think a similar comparison could be made with money: most people don’t want to have to know where to invest, what to save, how big a loan they can afford, etc. They just want to know that whatever money they have they can enjoy the most today and tomorrow.

At a recent mobile conference (Mobile Web Wars), Michael Arrington said: “people are always willing to give away their privacy for value”. This is a thought that came back to my mind as I was recently reading Lending, with a Twist, an article describing one of Khosla‘s investments: On Deck Capital. On Deck essentially reduces the risk with loaning to small businesses by tracking their business on a daily basis, which is a much better measure than a credit score that is always lagging valuable creditworthiness information.

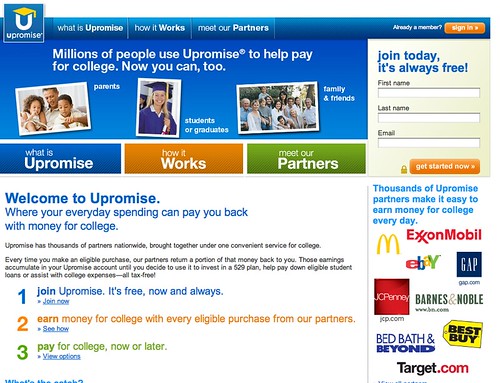

Reading about On Deck made me think that there was no similar financial service where consumers would voluntarily give their full past, present and future estimated financial picture to a third-party in exchange for true peace of mind. This could probably be done without even switching completely away from existing financial services providers, just as companies like Mint.com or Wesabe allow you to get a better understanding of your finances without swithing to Mint bank or Wesabe bank.

But to bring true piece of mind, such a service would have to go much further than giving recommendations and it would have to be backed by a highly trusted brand, with a value proposition backed by a wide portfolio of investments giving it preferred access to a wide variety of goods and services. This type of peace of mind used to be provided by large enough corporations to their employees, but it seems that such a responsibility is to heavy to bear for any a single industrial company, so it would have to be provided by some sort of conglomerate (companies have put in place strategies to focus on what they do best, but ironically that leaves most of us with less time to focus on what we do best). I don’t really have any name in mind, but Berkshire Hathaway may be the closest one I can think about.

Is this a crazy idea?