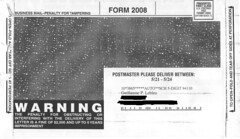

I recently received a pretty aggressive form of spam from a company based in Concord, CA. The outside was designed to look like some highly confidential and urgent material of legal and/or financial content. For instance, you could read on the front: “WARNING The penalty for obstructing or interfering with the delivery of this letter is a fine of $2,000 and up to 5 years imprisonment”.

As I opened it, I was genuinely worried, but quickly discovered it was just some kind of “Free offer* (*well, not really)” from a company called “Pulaski Tickets and Tours” based in Concord, CA according to the content of the spam. A Google query returned that the company is actually based in New York state and headed by a man named Patrick Harthough who lives here. The address in Concord is probably the address of a trash box for complaints.

Like most people, these types of mail waste my time (I shred any mail that is irrelevant) and now abuse my emotions.

I’d like to be able to do a little more than be able to trace this person and his company. I’d like to essentially publish somewhere, in a form that can be easily found and searched by others that this person’s marketing practices are questionable. This way, Mr. Harthough’s reputation is public and if enough people can easily do the same rather then just writing in forums, then people like me could automatically discard Mr. Harthough’s mails and perhaps people like Mr. Harthough would change their practices.

This type of real-time rating system is something I’ve been personally interested for many years, particularly as it applies to the hidden social and environmental costs of products people buy and use their social network of usually like-minded people to re-balance the current asymmetry of power between consumers and marketers. I think we are getting pretty close to a point where this type of system can be implemented (the technology of software UPC barcode scanners is getting to a point of usability, social networks are omnipresent, and Web-wide data queryability about companies and people is also making progress).

I recently discovered that a generalized version of this concept has a cool name: Whuffie, and that a book by Tara Hunt is coming out on the subject later this year.